SUSTAINABLE COFFEE CHALLENGE

THE STATE OF

SUSTAINABLE COFFEE

Coffee is one of our most cherished commodities. The world consumes about one billion cups of coffee per day, and demand for coffee has increased almost 50% in the last 12 years, growth that is expected to continue. Simultaneous to this increased demand, the ecosystems where coffee is grown are being impacted by climate change and variability, coffee farm workers seek safer and fairer workplaces, and many smallholder farms struggle for viability.

To address this, the Sustainable Coffee Challenge was formed “to make coffee the first sustainable agricultural product in the world”. The Sustainability Consortium (TSC) is a proud member of the Sustainable Coffee Challenge, which is being led by one of TSC’s key partners, Conservation International. As part of our commitment to the Challenge, TSC is releasing its “toolkit” of products in the Coffee category into the public domain. In doing so, we encourage commercial and non-profit organizations throughout the coffee supply chain to use these tools to learn more about hotspots and improvement opportunities in the coffee supply chain, use the KPIs to measure and share progress around key issues, and use the research reports as a basis for raising awareness and focusing action.

The following tools are now publicly available and free for use and distribution:

Coffee CSP and KPIs

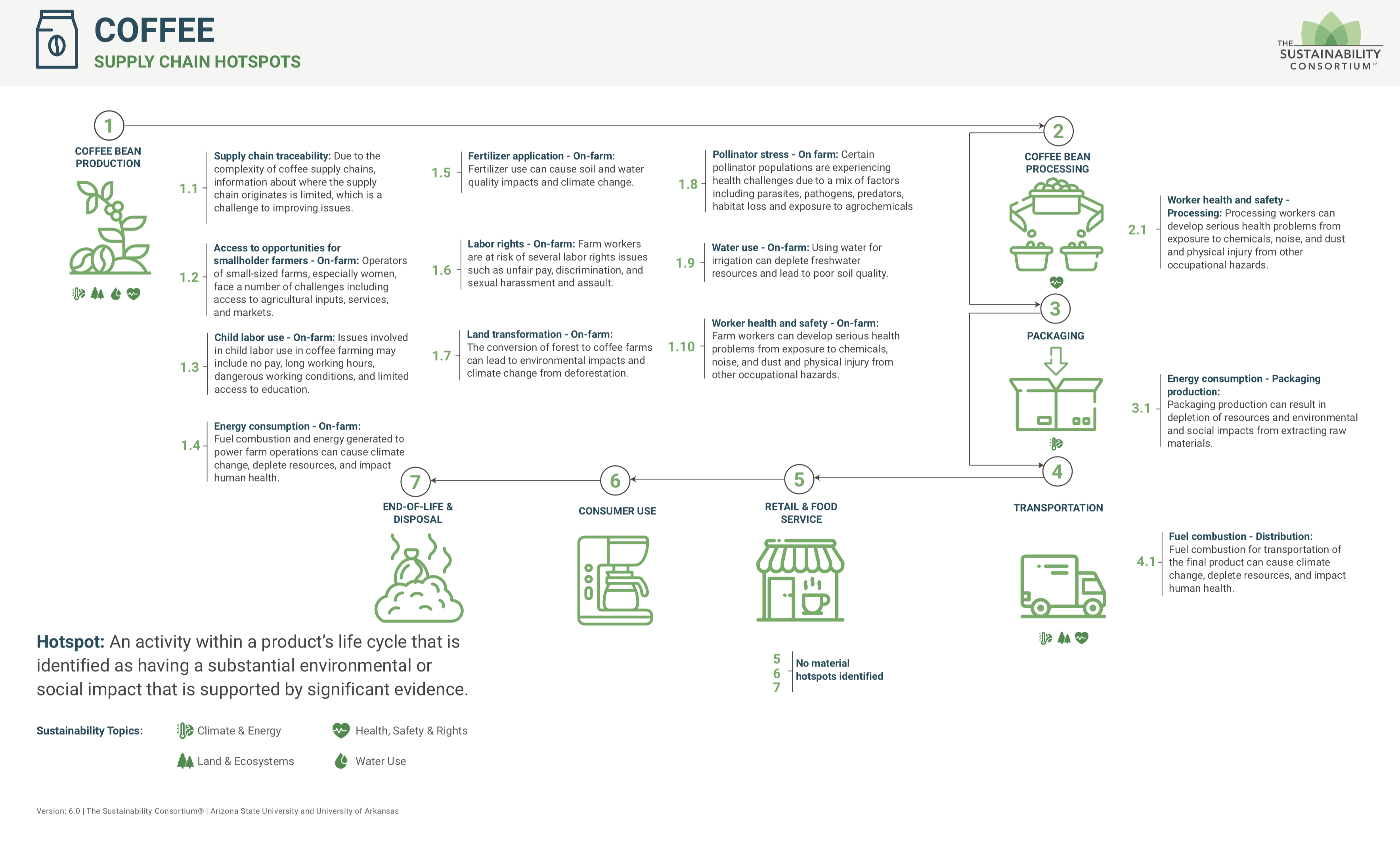

The Coffee Category Sustainability Profile (CSP) identifies the environmental and social hotspots and improvement opportunities across the coffee supply chain. The Coffee Key Performance Indicators (KPIs) can be used to measure progress against the hotspots.

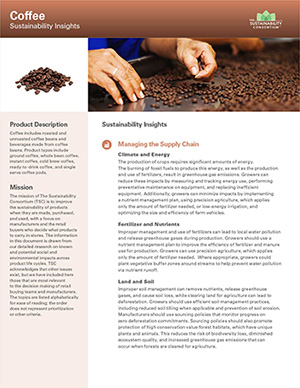

Coffee Sustainability Insights

The Coffee Sustainability Insights summarizes the Profile into a one-page, easy-to-understand document aimed at retail merchants and brand sales teams.

Coffee Supply Chain Diagram

Coffee Commodity Mapping Report

The Coffee Commodity Mapping Report demonstrates TSC’s commodity mapping services, which helps downstream buyers learn more about where they are sourcing from, and what risks there might be in those regions.

COFFEE SURVEY DATA

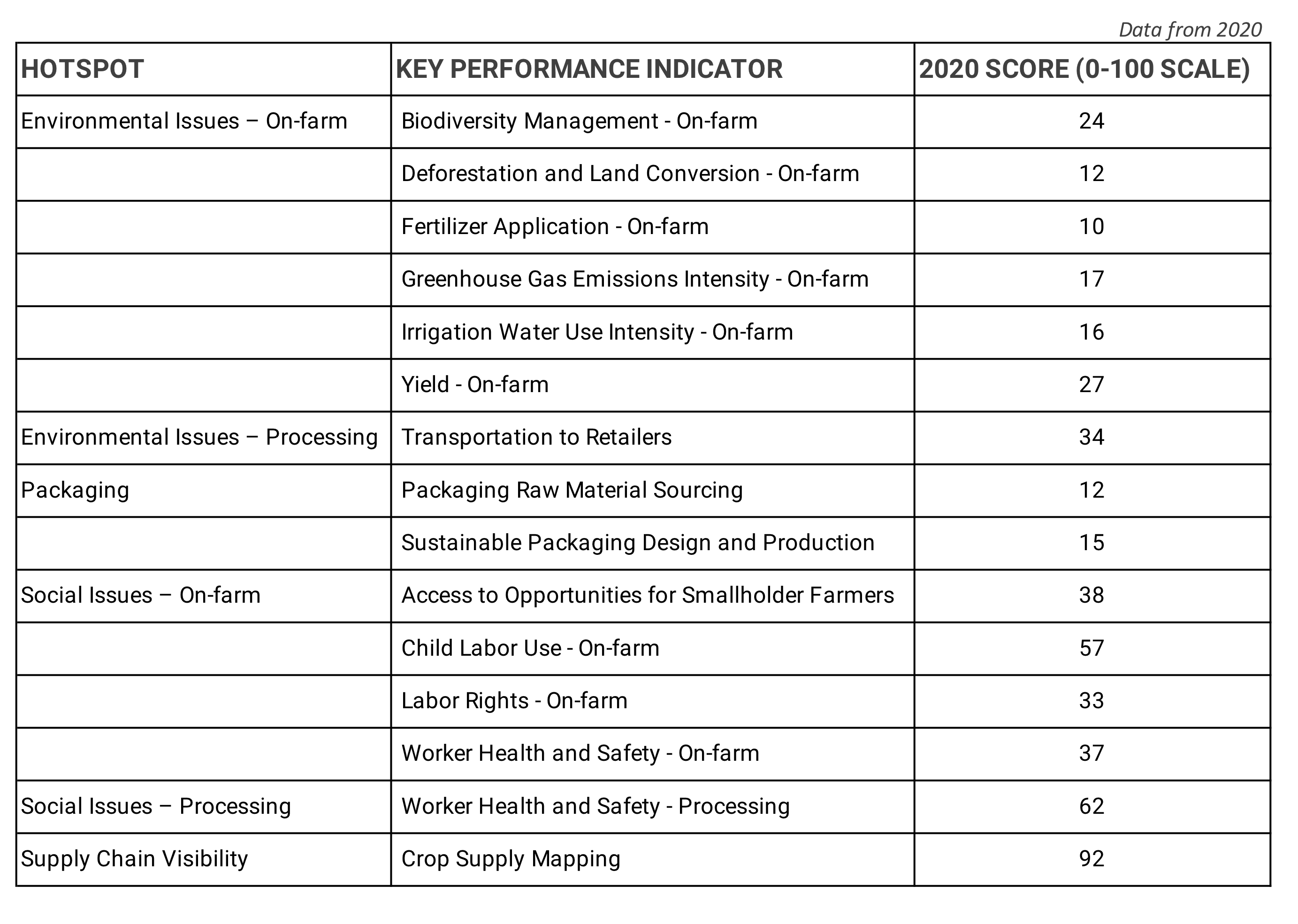

In 2020, 21 coffee manufacturers (brands and producers) used THESIS to assess their product

sustainability performance and share with Walmart, Sam’s Club, Walgreens, Sprouts, and other

retailers. The survey consists of 15 questions, or key performance indicators (KPIs), that the

coffee manufacturers responded to. The table below shows the performance of the 21

manufacturers, for the 15 KPIs.

In general, a 100% score on a KPI corresponds to the manufacturer’s ability to provide a

measure that represents 100% of their operations, or their supply chain operations. Conversely,

a 0% score represents that the manufacturer is unable to determine any measure of

performance for any of their operations or supply chain. For example, the 27% score on the

yield infers that only about one–quarter of coffee manufacturers have data on on–farm coffee

yields.

Scores (on a 0–100 point scale) remained relatively stable from 2019 to 2020, at 32/100.

Performance was highest on these KPIs: Crop Supply Mapping, Worker Health and Safety

(Processing), and Child Labor Use (on–farm). Scores were lowest (indicating low traceability or

transparency) for the on–farm environmental measures.

In general, a 100% score on a KPI corresponds to the manufacturer’s ability to provide a measure that represents 100% of their operations, or their supply chain operations. Conversely, a 0% score represents that the manufacturer is unable to determine any measure of performance for any of their operations or supply chain. For example, only 9% of coffee manufacturers have 90% visibility or higher as to whether their supply chain is free of deforestation and land-use risks. Conversely, 48% of coffee manufacturers have no visibility into risk.

There are two patterns in the scores that are similar to what can be seen in other categories. First, scores on KPIs related to social issues tend to score higher than those related to environmental issues. A coffee manufacturer was 50% more likely to say they were “unable to determine” an environmental KPI than a social KPI. We attribute this to their being greater attention, for a longer period of time, to social versus environmental issues, especially on the coffee farm itself.

Second, scores tend to decrease the farther away the hotspot is from the manufacturer. In this case, lack of traceability and difficulties in sharing data across multiple tiers of a supply chain get in the way of coffee manufacturers being able to know the risks in their supply chain.

It appears that almost all coffee manufacturers have worked hard to improve traceability. 93% of manufacturers are able to trace 90% or more of their coffee supply, to the country. Performance on the packaging related KPIs was not as strong. No manufacturers scored 90% or above on the two packaging KPIs, and 50% of manufacturers were unable to determine a response about packaging materials, or did not take sustainability into account during packaging design.

OUR COMMITMENT

TSC has joined forces with dozens of other corporations, NGOs, and service providers, including TSC members Ahold, IDH, and Conservation International, to be a part of the Sustainable Coffee Challenge. The goal of the Challenge is for participant organizations to make sustainability-related commitments, with the vision of making coffee a completely sustainable crop. Conservation International serves as the Secretariat for the Challenge.

TSC’s commitment is “By 2020, The Sustainability Consortium (TSC) will be supporting global retailers in the deployment of supplier surveys covering 100M USD in coffee purchasing, thus sending a strong market signal for sustainable coffee. To facilitate this, TSC has released its coffee supplier survey and other components of its coffee toolkit into the public domain.”

This goal is a natural extension of our more general goal around TSC metric adoption. In addition to this goal, we would like to explore other ways in which our members, and other participants in the Challenge, could interact to improve the coffee supply chain. For those interested, please contact Kevin Dooley.

CONTACT US

Kevin Dooley

Chief Scientist

kevin.dooley@sustainabilityconsortium.org